Amortization Which Means, Method, Example, Varieties, Vs Capitalization

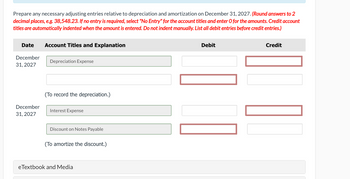

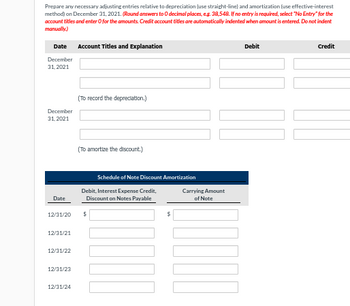

Understanding amortized loans can empower your monetary decisions by revealing how payments cut back debt over time. An amortization schedule for this loan would come with columns for total payment, interest due, principal due, and remaining stability. This detailed breakdown helps debtors understand how their payments are distributed and monitor the reduction of their loan steadiness over time, together with the mortgage amortization schedule. Understanding amortization aids in efficient monetary planning and management.

The calculator can also present payment schedules and the influence of various mortgage terms on general payment quantities. This clarity helps debtors make informed choices about their loans and monetary obligations. Mortgage amortization works by paying off debt via common installments over time.

Why Is Knowing Amortization Important?

If the television continues to work after the end of its useful life, it’s going to tackle a residual value. Knowing the real worth and helpful lifetime of our belongings, and the amount we owe on, and the time period of, our loans, are key to managing our finances better. Accounting steering determines whether or not it’s right to amortize or depreciate. Each options spread the worth of an asset over its helpful life and an organization does not gain any financial advantage through one somewhat than the other. Your lender ought to provide an amortization schedule showing how a lot of every payment will comprise interest versus principal.

What’s A Loan Amortization Schedule And The Way Can Or Not It’s Created In Excel?

Amortization is the affirmation that such property maintain value in an organization and must be monitored and accounted for. These regular instalments are generated utilizing an amortization calculator. The allocation of prices over a specified interval should be paid in full by the point of the maturity date or deadline. An instance of an amortized intangible asset could be the licensing for equipment or a patent for your small business.

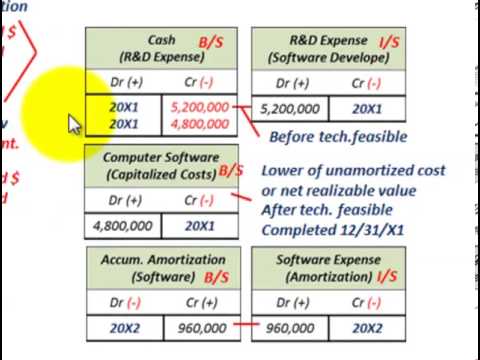

The sum-of-the-years digits methodology is an instance of depreciation by which a tangible asset such as a automobile undergoes an accelerated technique of depreciation. A firm recognizes a heavier portion of depreciation expense during the earlier years of an asset’s life under this methodology. More expense must be expensed throughout this time as a outcome of newer property are more efficient and more officious than older assets in theory. The credit facet of the amortization entry might go on to the intangible asset account relying on the asset and materiality. Depreciation entries all the time submit to accrued depreciation, a contra account that reduces the carrying worth of capital belongings. Merriam-Webster supplies some speed up synonyms that embrace “quickened” and “hastened.” A bigger portion of the asset’s value is expensed in the early years of the asset’s life.

Though you’ll have heard the word “amortization” at residence and at work, you might have questions over its meaning. If we take the sentences “the automobile is now amortized” and “the loan amortization schedule might be 5 years”, they appear to level to completely different ideas. Kiah Treece is a former attorney, small business proprietor and private finance coach with intensive expertise in actual estate and financing. Her focus is on demystifying debt to assist consumers and business homeowners make knowledgeable monetary choices.

The declining steadiness technique of amortization calculates greater initial deductions that decrease over time as the asset’s value reduces. This methodology applies an amortization fee to the remaining book worth of the asset, leading to larger deductions within the earlier years and smaller deductions as the asset ages. Month-to-month funds for loans, like automobile loans or mortgages, embody both an interest payment and principal, highlighting the distinction between interest versus principal. Initially, a larger portion covers interest, however over time, more of the cost is allocated to the principal. With the knowledge laid out in an amortization table, it’s straightforward to gauge completely different loan options. You can examine lenders, select between a 15- or 30-year mortgage, or decide whether or not to refinance an existing loan.

- To such an end, the International Accounting Requirements Board’s IAS 38 sets out guidelines on how intangibles must be amortized.

- A software company amortizes a $1 million patent over 10 years, reporting a $100,000 amortization expense yearly, impacting EBIT but not EBITDA.

- In an amortized loan, the scheduled and periodic loan payments are usually the identical amount each time.

- It demonstrates how every cost impacts the mortgage, how a lot you pay in curiosity, and how much you owe on the mortgage at any given time.

Dreamzone divided the acquisition worth by the helpful life to amortize the patent’s cost. It’s also helpful to calculate the amortization of technology units so we know when they’ll want changing. That means https://www.simple-accounting.org/, we can set aside a sum in our price range to avoid a sudden blow to our wallet.

They might generate or contribute to income in perpetuity – for example, broadcasting rights that could be continuously renewed with out a lot value to the holder. These forms of intangible property usually are not usually subject to amortization but are subject to annual impairment checks. When a mortgage is fully amortized, it means that when you make the entire regularly scheduled payments, your mortgage will be absolutely paid off at the finish of the term. Most mortgages and other client lending merchandise (like private loans or auto loans) are absolutely amortized.

Recognizing these differences aids in correct asset worth reporting and monetary obligation management. Knowing the professionals and cons of amortization aids businesses and individuals in making knowledgeable choices about managing monetary obligations. Consulting with monetary consultants is crucial when companies face advanced amortization scenarios, notably for tax implications. Professional financial consultants can present tailored advice on amortization to optimize tax advantages. Amortization schedules present a clear view of this breakdown, helping to create predictability and stability in financial planning. The finest approach to perceive amortization is by reviewing an amortization table.